Higginbotham’s Day Two Services® for employee benefits are designed to take the complexity out of managing your benefits package. Our benefits support team can help lighten your HR team’s workload through a suite of services, including:

Compliance and COBRA Administration

Our team can help you navigate the complexities of health care laws, COBRA and other applicable federal, state and local regulations, working to help keep your business compliant.

Employee Response Center

Our in-house call center provides your employees with direct access to our benefits specialists, reducing the burden of your human resources team. Employees can call or email Higginbotham’s Employee Response Center to ask questions or receive assistance on topics ranging from open enrollment to health insurance claims.

Benefits Communications

Effective communication is key to helping your employees understand and appreciate the value of their benefits package. Our benefits communications team can create customized strategies and collateral that provide information on benefits options, open enrollment, employee wellness programs, total compensation packages and more.

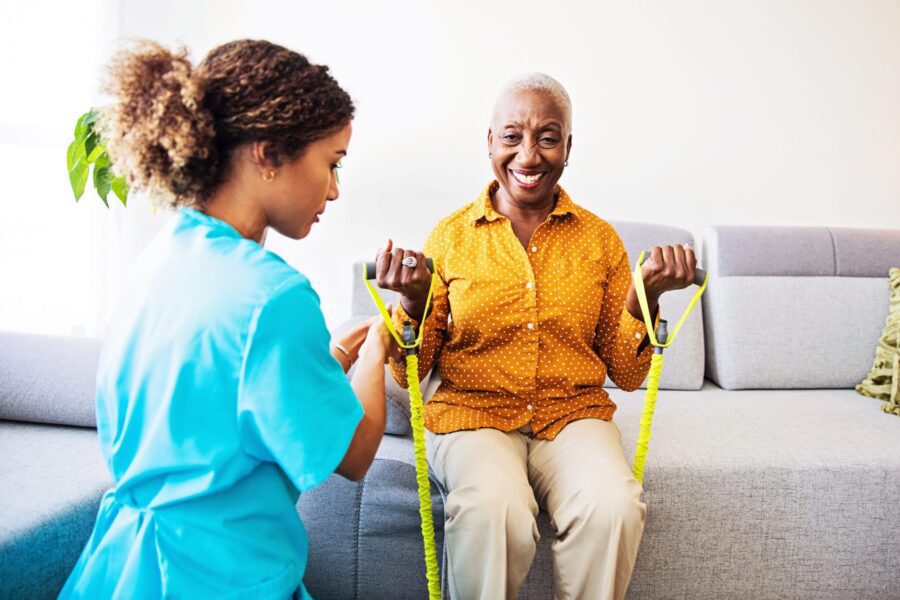

Employee Wellness Programs

Effectively promoting health and wellness within your organization can lead to reduced health care costs and improved employee productivity, morale and retention. Our population health management team can design and implement customized wellness programs that are tailored to your workforce, helping to encourage healthy lifestyle choices and employee wellness.

Benefits Administration

Managing the day-to-day aspects of your benefits programs can be challenging. Our benefits administration services can help manage open enrollment, FSA and HRA administration, plan changes and other benefits administration tasks, allowing you and your HR team to put a greater focus on your most important asset: your people.