Commercial Auto Insurance

We’re driven by a commitment to authenticity.

We’re driven by a commitment to authenticity.

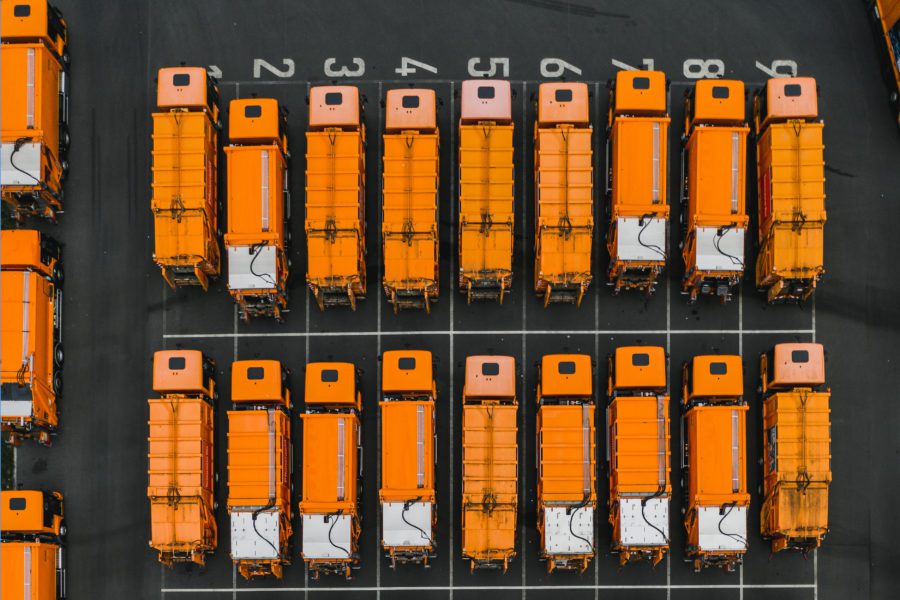

If your organization owns commercial vehicles or drives for business purposes, you probably need commercial auto insurance. Designed to cover liability for bodily injury and physical damage caused by vehicles used for business purposes, this business insurance is essential for companies that use automobiles as part of their operation.

Whether you are a general contractor looking to buy a new work truck, bakery with a fleet of delivery vans, food truck owner, process server or another professional that drives for work, driving for business poses a unique set of risks.

With these risks in mind, the importance of car insurance cannot be overstated. Our seasoned auto insurance specialists get to know your business by name and nuance, so we can deliver a custom-tailored policy designed around your specific needs.

Employee owned and customer inspired, we aren’t afraid to take the road less traveled.

That’s why we take the time to get to know your unique operation to help ensure we suggest the right commercial auto options for your needs. And, that’s why we leverage our deep industry knowledge and time-tested relationships to deliver solutions other’s can’t.

Because when you lead with values, year-round value leads.

To learn more about how our values-based approach drives value for your business, click here.

You may be surprised to learn that a commercial auto policy can often extend coverage to rental cars and employee-owned cars used for business purposes.

Learn more about what commercial auto insurance from Higginbotham can do for you.

When you or an employee drives a vehicle for commercial use, your business could be held responsible for any damage or injuries they may cause if they are involved in an accident. In some cases, an at-fault accident can end up getting you entangled in a lawsuit that threatens your business.

While a commercial auto insurance policy usually has a higher coverage limit than the personal auto insurance we carry on our cars, you may want to consider umbrella coverage to increase your liability limits if your risk exposure is above average.

Designed to protect your business vehicles and limit your liability while driving for business purposes, commercial auto insurance can help with the cost of:

At Higginbotham, we set ourselves apart from the average insurance company with our bespoke approach commercial auto insurance. Whether you need coverage for a single company vehicle, a fleet of tractor-trailers or anything in-between, the business auto insurance experts at Higginbotham have you covered. We take the time to understand unique situation and needs to help make sure we deliver coverage options that make sense for your business.

While the coverage that makes sense for your policy will depend on specifics like your location, operation, vehicles in your fleet, and other factors, most commercial auto packages include the following protections:

This coverage intends to limit your legal liability as it relates to an at-fault accident. If you or an employee causes an accident that injures a third party or damages someone else’s property, your auto liability can help pay to make things right.

If you, an employee, or passenger suffers an injury in an accident involving your commercial vehicle, this coverage can help with the costs of medical treatments for resulting injuries. Unlike most other commercial auto coverages, medical payment coverage does not consider who is at fault in determining claim eligibility.

Functioning much in the same way as the comprehensive we carry on our personal autos, comprehensive coverage can help pay for damage to your vehicle caused by vandalism, theft, extreme weather, and other threats.

This coverage helps pay for damage sustained by your vehicle in a collision. Covered perils typically include collisions with other cars (regardless of who is at fault), collisions with objects and vehicle rollovers.

If your commercial vehicle is involved with an accident with an uninsured or underinsured motorist, this coverage can help pay for medical expenses, loss of income, collision damage and other costs that may result. It’s important to note that uninsured motorists coverage typically only pays expenses not covered by your workers’ compensation insurance. Using this coverage is similar to the process of making a claim against another driver’s policy and claims do not carry a deductible.

Regardless of how often you drive, any business that owns commercial vehicles, rents commercial vehicles or drives for business purposes needs commercial auto insurance. If you drive for a rideshare service like Uber or Lyft, your commercial auto insurance needs may differ. Speak with a commercial auto expert today to find out what coverage makes sense for your needs. Some examples our commercial auto clients include:

While semi-trucks and other class 7 and class 8 fleet vehicles require specialized fleet insurance, Higginbotham can place coverage for most commercial vehicles used by businesses in the United States.

Some examples of vehicles eligible for commercial vehicle coverage include:

Factors such as ownership by a business, use in hauling goods for hire and gross weight determine a vehicle’s eligibility for a commercial auto policy. Except for auto-related businesses, motor carrier and trucking firms, a commercial auto policy addresses the auto insurance needs of most commercial entities.

In select cases, small vehicles used for business purposes can be insured on a personal auto policy.

At Higginbotham, we take a consultative approach to customer service and risk management.

Whether you have a single policy, a commercial package or many insurance policies covering multiple locations and risks, we take the time to understand your unique needs so we deliver the best coverage at the best price available.

But we don’t stop there.

Our work continues 365 days a year. We have a Day Two Services® team that works in tandem with our risk management specialists to deliver year-round value.

From help with compliance to safety audits and claims advocacy, our Day Two Services® team helps you mitigate risks, avoid costly claims and better position your operations so you can focus on what matters most: growing your business.

Get a custom auto insurance quote for your business today, or speak to a member of our team to discuss your coverage needs.