Inland Marine Insurance

Coverage that goes the distance. Peace of mind for your property in transit.

Coverage that goes the distance. Peace of mind for your property in transit.

Your business moves us. So if your business transports inventory or property owned by other people, we may recommend inland marine insurance.

Inland marine insurance is a specialized form of commercial property insurance that helps cover movable or in-transit property. If you transport inventory or property owned by other people as part of your business operation, you likely need this coverage.

While available to protect goods in transport by sea, inland marine coverage is more commonly purchased to protect shipments over land.

Because our know-how knows.

It knows that the coverage provided by shippers for property in transport often falls short of the actual value of the property being shipped.

It knows the value that tailored inland marine coverage can offer your business. And it knows the power of being individual in a world that’s institutional.

So explain your needs, and we’ll get to work. Our prices are competitive, our fees are clear, and our deep industry relationships allow us to go above and beyond while delivering year-round value so you can worry less and accomplish more.

To learn more about how our values-based approach drives value for your business, click here.

Or visit our Insights page to learn about inland marine general liability.

Designing an insurance plan that considers all of your exposures can be overwhelming. With our nationwide network of insurance carriers and industry experience, we can help take the headaches out of getting the custom coverage you need.

I recently purchased yet another policy through my long-time friend at Higginbotham. They are simply the best!

Inland marine insurance is a property insurance policy designed around exposures that cannot be reasonably confined to a fixed location or insured under a standard policy.

This business insurance applies to property in transit over land, certain moveable property, property under construction, instrumentalities of transportation and communication like bridges, roads, piers or television/radio towers, legal liability coverage for bailees and computerized equipment.

Coverage is available as a standalone insurance policy or as part of a package like a business owners policy or commercial package policy.

Some industries that commonly carry this coverage:

Inland marine coverage for construction can help protect materials and fixtures in transport to construction projects and job sites. This coverage can also help protect rental equipment and other third-party property while it’s in the possession of a construction business.

Inland marine insurance can protect vital communication infrastructures, such as towers and other electronic equipment. It can also protect equipment used in renewable energy production, including windmills, solar panels and more. In most cases, inland marine can protect this equipment during transport, installation and use.

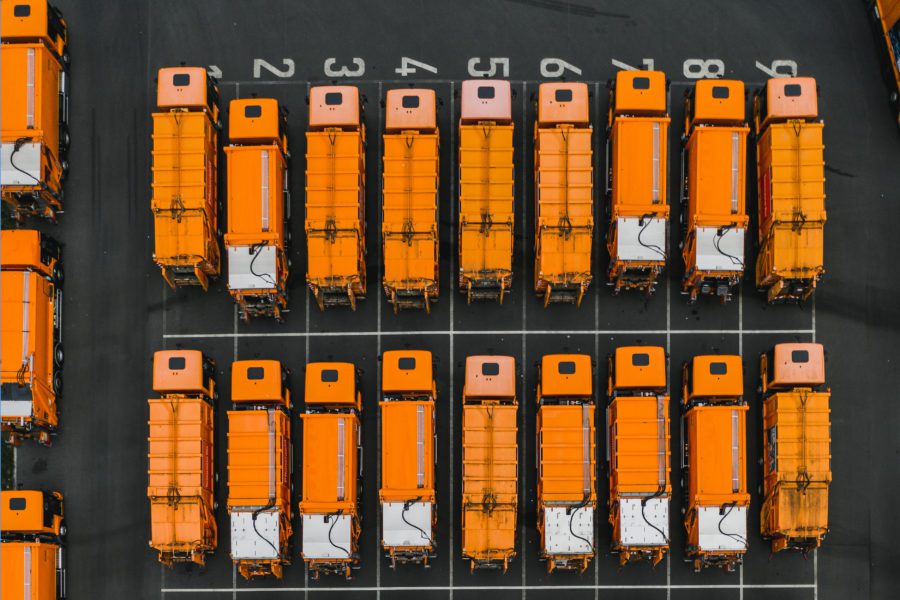

Businesses in the transportation and logistics industries may need inland marine coverage due to their frequent transportation of valuable cargo and inventory.

Inland marine insurance can benefit equipment manufacturers and other professionals who regularly transport high-value or specialty equipment. Whether you work as a third-party shipping provider for a manufacturer or do your shipping in-house, this coverage can protect your valuable equipment against loss or damage.

Coverages such as bailees liability, fine art coverage and collectibles insurance are designed with a jeweler’s or collector’s needs in mind. This specialized inland marine insurance can help protect fine art and other high-value property when it’s under the custody or care of a business that repairs, exhibits or sells it.

Similar to inland marine insurance, albeit tailored to the risks of transporting property by water, ocean marine coverage helps protect property in transport by sea.

Capable of covering the transport of goods and merchandise by vessels crossing foreign and domestic waters, including inland or aviation transit associated with the shipment, ocean marine insurance can also cover physical damage to vessels involved in shipping and the legal liability created by their operation.

Whether you transport raw materials and commodities, ship products manufactured overseas to the U.S. or transport goods your company produces to sell in other countries, ocean marine insurance is a vital protection to consider.

Ocean marine coverage is typically available as standalone coverage or as part of a larger package policy.

Some examples of industries that may need this coverage include:

In most cases, this coverage is bundled with other essential protections for maritime transport, such as:

Ocean cargo insurance helps protect property throughout the manufacturing and transportation process, from raw materials at the beginning of production to finished goods arriving at their end destination. Capable of safeguarding against a broad spectrum of threats to goods in manufacture and transport, this coverage can help pay for damage or loss caused by natural disasters, accidents and more.

This ocean marine coverage helps protect the vessel or fleet used to carry goods from physical damage incurred throughout transport. Capable of extending protection to tugboats, barges, floating machinery and even oil rigs, this coverage can limit liability for a range of maritime businesses. In most cases, hull and machinery insurance can also cover other ship components, such as an engine, generator, lighting and temperature control system.

Protection and indemnity coverage is liability insurance designed to cover the liabilities created by operating a watercraft. Capable of covering the cost of property damage, bodily injuries and fatalities arising out of the use or ownership of a marine vessel, this coverage is crucial for businesses that transport goods by sea.

Designed to cover a wide range of liabilities created by operating a commercial maritime vessel, MGL coverage can help pay to remedy damage inflicted upon a third party by your business operation. Capable of protecting against the costs of bodily injury and property damage, marine general liability is vital to your marine transportation business.

Because no two customers are alike, we take the time to learn the specifics of your business operation before providing you with a quote that makes sense for your needs.

From there, we’ll provide inland marine insurance customized for your needs at a price that makes sense for your business.

At Higginbotham, we take a consultative approach to customer service and risk management.

Whether you have a single policy, a commercial package or many insurance policies covering multiple locations and risks, we take the time to understand your unique needs so we deliver the best coverage at the best price available.

But we don’t stop there.

Our work continues 365 days a year. We have a Day Two Services® team that works in tandem with our risk management specialists to deliver year-round value.

From help with compliance to safety audits and claims advocacy, our Day Two Services® team helps you mitigate risks, avoid costly claims and better position your operations so you can focus on what matters most: growing your business.

A great plan starts with a conversation. Let’s talk about what you need.