Ranch Insurance

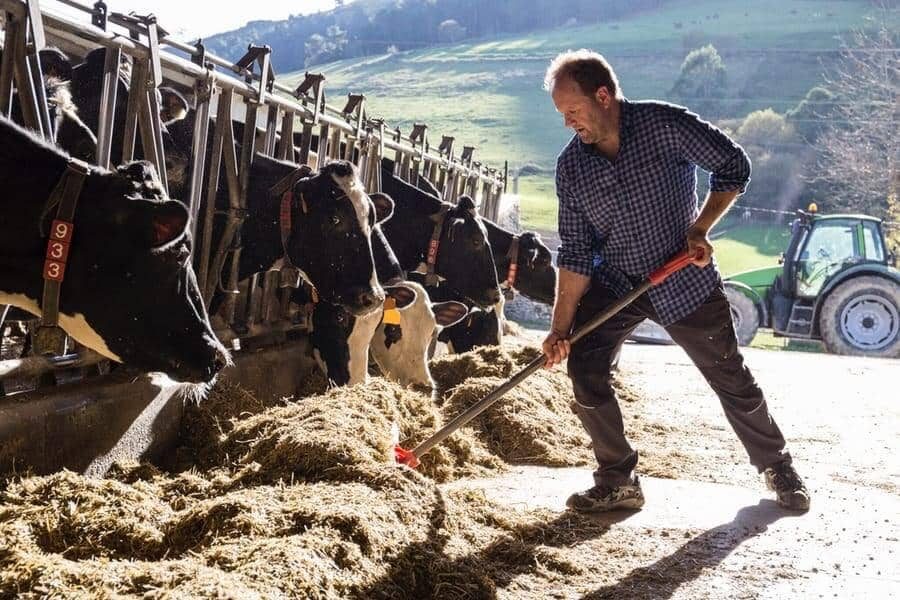

Bring peace to your pastures.

Bring peace to your pastures.

Livestock insurance is a key component of ranch insurance coverage, offering protection for your ranch’s most valuable assets – your animals.

Cattle or livestock insurance is designed to safeguard your animals from a range of events and perils, such as theft or death. In the case of a covered loss, a livestock insurance policy will help cover the cost of resolving the issue.

And, with additional policy options like livestock liability insurance, which offers support for damages or injuries inflicted by your livestock on others or their property, taking care of your herd is simpler than ever.

Higginbotham offers farm and ranch insurance for a wide variety of animals and livestock, including horses, cattle and poultry. Examples of farm and ranch animals we insure include:

At Higginbotham, we understand the diverse needs of ranchers, and that’s why we work with national insurance carriers to find comprehensive, customized and competitively priced coverage options for our clients.

We’re committed to helping you navigate the complex world of ranch insurance and risk management so you can focus on what matters: growing your business.

When it comes to livestock insurance, you have several coverage options, including:

Each option has its advantages, so consulting with an experienced ranch insurance broker can help you determine the best coverage option for your business.

While livestock insurance offers valuable protection for your animals, it’s essential to be aware of the limitations and exclusions that may apply. Restrictions associated with farm animal and livestock insurance may include aging, certain illnesses, death due to natural causes and per-animal value limits. Adding an animal perils endorsement to your policy can increase the scope of your coverage to include risks like accidental shooting, building collapse or drowning.

In addition to livestock and cattle insurance, there are several other common ranch insurance coverages that can provide comprehensive protection for your ranch operations. These commercial coverages include:

Property insurance is essential for safeguarding the buildings, equipment and other assets on your farm or ranch. It can cover damages to your property due to fire, theft and vandalism, helping offset the financial burden placed on your business during difficult times.

General liability insurance is another crucial component of ranch insurance, providing coverage for claims of bodily injury or property damage caused by you or your employees. Liability insurance can help pay for damages, including medical expenses, legal fees and property repair costs.

Business interruption insurance is an important coverage option for ranch owners. It helps replace lost income and cover additional expenses when your ranch is unable to operate due to a covered loss or damage. With business interruption insurance, you can keep your ranch running, even during unexpected events.

If you live on your ranching operation, personal property coverage is essential, as your belongings are likely not covered under your commercial ranching policy. Homeowners’ insurance and other forms of personal coverage can help protect your home and personal belongings against damage, theft, fire and other covered perils.

If you’re self-employed or have employees working for you, health insurance is an important consideration. With Higginbotham as your health insurance broker, you have access to a range of options, such as group plans, individual plans and alternative options like Health Savings Accounts, giving you and your team access to preventative care and health services to keep you going.

Because we’re more than just an insurance broker; we’re your partner in success.

With Higginbotham’s range of personal and commercial insurance solutions, you can secure competitively priced coverage from national insurance carriers.

But getting you covered is just what we do on day one. Our insurance, risk management, compliance, certificate validation, claims management and contract review specialists are there for you year-round, offering value-added support that goes beyond insurance.

As a rancher, you face a variety of risks in your day-to-day operations. But, determining what these risks are and how to mitigate them can be difficult and time-consuming, taking time away from tending to your land and animals.

Higginbotham takes the guesswork out of ranch risk management by helping you control costs and reduce risks with an insurance and risk management program that aligns with your business objectives, budget and level of exposure.

From environmental risks like droughts or fires to legal risks like regulatory compliance, we’re here to help you minimize losses and secure your ranch’s long-term success.

Don’t leave the future of your ranch to chance. With us, you’re in good hands.

With Higginbotham as your partner, you can enjoy the peace of mind that comes with knowing that your ranch is well-protected against the unexpected.

Take the first step toward safeguarding your land and livelihood by talking to a ranch insurance specialist today.